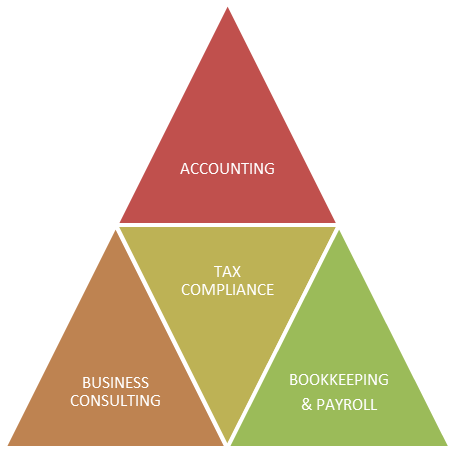

Ketan R. Sheth, An Accountancy Corporation is a full service accounting, consulting and tax service firm.

The firm was established in January 2008.

Our mission is to provide quality services with professional competence and commitment at reasonable cost.

We take pride in providing high quality service tailored to meet our clients’ specific accounting and tax service requirements. Our goal is to provide superior professional services with personalized attention to our client’s needs.

We just don’t talk with you but we try to walk with you.

Please visit "About Us" for who we are, "Our Services" for what we can offer to meet your needs and our newsletter with other useful links.

Our office location is 10805 Holder Street, Suite 205, Cypress CA 90630.

Telephone: 562-912-1347

Fax: 877-841-1347